estate trust tax return due date

Estate tax returns must be filed by the. Form W-2 W3 1099 NEC and 1096 NEC.

Significant Changes To 2021 Trust Reporting Requirements Bateman Mackay

Federal estate tax returns are due no later than 9 months after the deceased persons date of death.

. Fiduciaries of the following types of estates and trusts are required to file Form 1041. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. Quarterly Payments by paper check mailed with form to Michigan Department of Treasury.

One of the more complex and intimidating business income tax returns that is due for many filers. You must fill in the dates of the short year at the top of the return. Personal representative of the estate or.

And deductions that were made to or by the trust or estate during the tax year to the IRS. When filing an estate return the executor follows the due dates for estates. If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to request an extension.

Monday April 11 2022. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. However you may want to file the final return before that time.

Estate tax returns and payments are due 9 months after the date of the decedents death. Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets. Form 1065 for Partnerships 15th March 2022.

Owner or Beneficiarys Share of NC. Beneficiarys Share of North Carolina Income Adjustments and Credits. Fin CEN 114 FBAR.

If the due date falls on a weekend or holiday the due date is the next business day. Refer to IRS Form 706. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Link is external 2021. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019--10-JUL-2020. NC K-1 Supplemental Schedule.

If you pick Dec. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. So if you elect to end the year on November 30 your short-year return is now due on March 15 not April 15.

Form 1041 for Trusts and Estates 18th April 2022. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

31 rows Generally the estate tax return is due nine months after the date of death. 13 rows Only about one in twelve estate income tax returns are due on April 15. Limitation on business losses for certain taxpayers repealed for 2018 2019 and 2020 --19-MAY-2020.

For estates and trusts operating on a calendar year this. Returns must be sent by mail. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension.

If you wind up an inter vivos trust or a testamentary trust other than a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts tax year-end. The decedent and their estate are separate taxable entities. Due Date for Estates and Trusts Tax Returns.

Ad Access IRS Tax Forms. For trusts operating on a calendar year the trust tax return due date is April 15. Estate trust tax return due date.

Due dates and mailing addresses Estates. Complete Edit or Print Tax Forms Instantly. Annual Return Filing Options.

Any person in actual possession of the decedents property. Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic-- 14-APR-2020. Due Date For Filing.

For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month following the close of the tax year. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. An estate administrator has the option of either setting the trust up on a calendar.

The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year. Form 1120 for C-Corporations 18th April 2022. Form 1120S for S-corporations 15th March 2022.

An estates tax ID number is called an employer identification. Application for Extension for Filing Estate or Trust Tax Return. 31 for instance that gives you until April 15.

15th day of the 4th month after the close of the trusts or estates tax year Every trust is required to file income tax return on or before 31st july after the end of financial year. Unlike personal tax returns trust tax returns have more than one due date. The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the end of the fiscal year if on a fiscal year basis.

Form 1040 for Individuals 18th April 2022. If you opt to use a short year for the final return dont forget that the return is still due three and one-half months after the end of the year youve chosen. Visit the Estates and Trusts Tax Forms page to select Form 5462 for the appropriate tax year.

An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of the. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets. The gift tax return is due on April 15th following the year in which the gift is made.

The form to file is 1041 the income-tax return for trusts and estates. File an amended return for the estate or trust. Complete IRS Tax Forms Online or Print Government Tax Documents.

California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541 BK Visit Forms to get older forms. IRS Form 1041 US.

What Are Us Tax Due Dates Artio Partners Expat Tax

Canadian Tax Return Deadlines Stern Cohen

Filing The T3 Tax Return Advisor S Edge

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

1041 Name Control Guidelines Ef Message 5300 Irs Reject R0000 901 01

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Distributable Net Income Tax Rules For Bypass Trusts

How To Prepare Final Return Of A Deceased Person In Canada

How To Prepare Final Return Of A Deceased Person In Canada

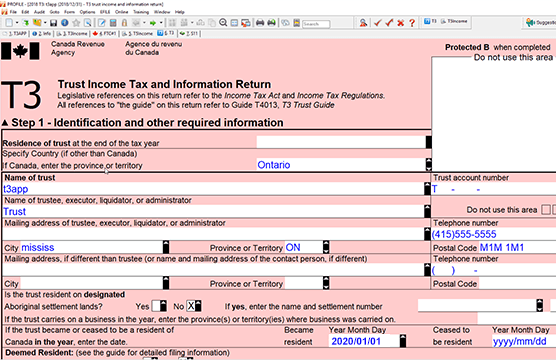

T3 Trust Tax Preparation Cra Efile Software Profile

The Generation Skipping Transfer Tax A Quick Guide

Filing Taxes For Deceased With No Estate H R Block

The Generation Skipping Transfer Tax A Quick Guide

How To Prepare Final Return Of A Deceased Person In Canada

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Preparing Your Trust Tax Returns 2022 Edition For 2021 Returns

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service